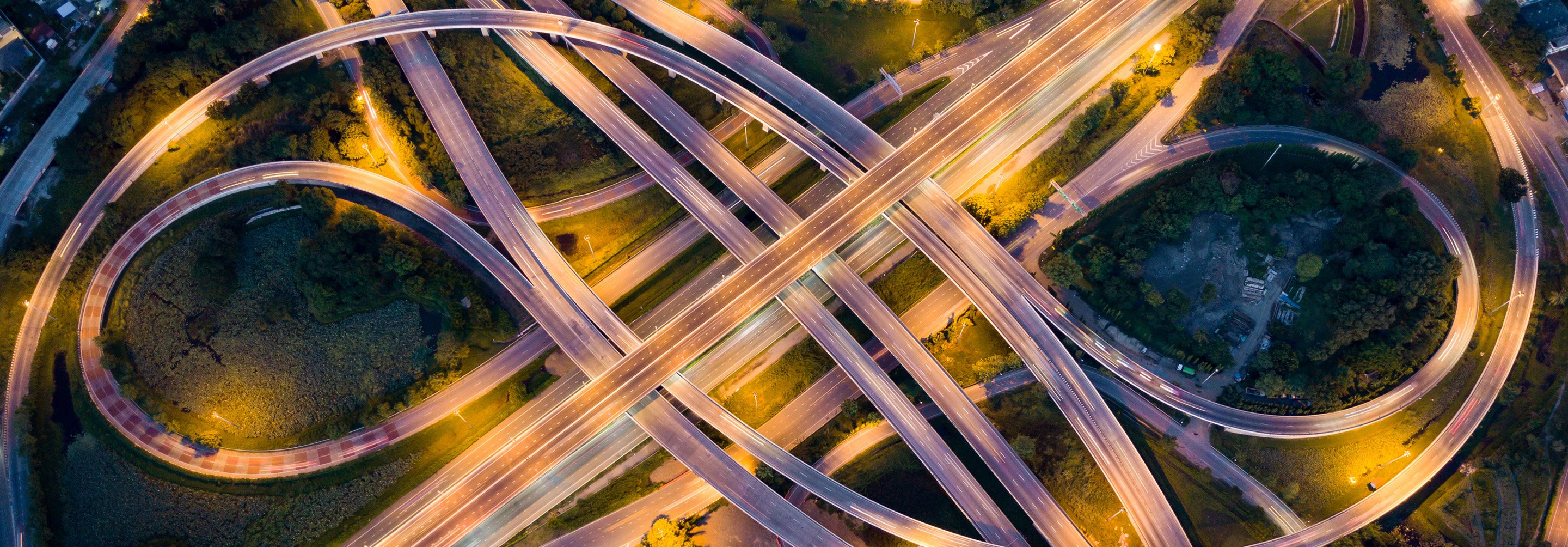

Transportation

Protecting Your Fleet Exposures to Keep Your Business Moving

In the transportation business, your journey involves challenges like worker retention, shifting fuel costs, and complex regulations. As one of the nation’s largest transportation insurance brokers, we know these challenges well. Our Transportation Practice places over $1 billion in premium, serving transportation companies from one to over 25,000 power units. Count on our team to proactively support your business and protect its future.

Transportation Sectors We Serve

- Truckload

- LTL

- Flatbed

- Tanker

- Intermodal

- Moving and storage

- Third-party logistics

- Courier

- Last Mile

- Passenger

- Gig economy

We’ve staffed our Transportation Practice with industry leaders, including former transportation company risk managers, attorneys, claims managers, and insurance underwriters. The same people serving as your primary contacts will also negotiate directly with underwriters on your behalf and be involved in all aspects of a claim.

Coverage Solutions

We have the expertise and breadth of products and services available to meet your needs including:

- Auto Liability

- Physical Damage

- Cargo

- General Liability

- Excess Liability

- PEO

- Occupational Accident

- Workers’ Compensation

- Contingent Liability

- Shippers Interest

- Warehouse Legal

- Property

Alternative Risk Finance

From self-insurance and structured risk to single-parent and group captives, our Transportation Practice will help you evaluate if an alternative risk finance strategy would be the right fit for your organization. Our consulting services include:

- Actuarial

- Self-insurance studies

- Captive feasibility

- And more

Fleet Safety

Our experts will conduct a GAP Analysis of your existing safety management controls and benchmark your company against fleet safety best practices and industry standards. Our first-hand knowledge of today’s safety and compliance-related issues will help you improve productivity and profitability.

Additional safety services we can provide include:

- CSA score analysis

- Active shooter training

- Exposure control plans

- Business continuity plans

- Safety management system

- DOT drug clearinghouse

- On-board camera systems

- Business intelligence tools

- OSHA review and training

- Medical emergency training

- Heat illness prevention

- Fatigue management

- Just culture for safety

- Safe driver recognition programs

-

McGriff Analytics Platform

With insights from the McGriff Analytics Platform (MAP), you have a holistic view of risk to move forward with confidence. MAP facilitates a real-time, dynamic conversation about your risk financing options, providing:

- A forward look at risk, using McGriff’s deep pool of claims, exposure, and placement data across industry, size, geography, and product.

- A customized view that combines industry-leading loss modeling with analyses of key income statement and balance sheet drivers.

- Informed decisions on optimal risk financing structures or risk mitigation investments.

-

Independent Contractor/ Small Fleet Programs and Compliance

Our solutions protect corporate risk program structures for independent contractor exposures while assisting with recruitment and retention goals.

- Insurance program design and implementation

- Contract review

- Administration

- Claims advocacy

- Insurance certificate tracking

- Motor vehicle records

- Background checks

- Drug screenings

- Document storage

-

Freight Brokerage Transactional Solutions

As technology continues to evolve, both traditional and tech-based startups are creating platforms to improve efficiency across the supply chain. From initial whiteboard concepts to execution, we work with our clients to implement custom solutions to harness those efficiencies.

-

Legal Resources & Support

Our resources for contract review and contractual risk transfer consulting are unmatched in the transportation risk and brokerage community.

We routinely assist in the review, analysis, and evaluation of any potential impact that third-party contracts may have on our clients’ risk profile.

We can also provide a contract review training session to instill an insurance/risk management perspective across functional areas such as legal, insurance procurement, safety, etc.

Please Note: Any review by McGriff, or its representatives, of third-party contracts is done so solely as an advocate for you in assessing your risk management program. We do not certify to the completeness nor adequacy of any third-party contract to which you are a part. Please consult with your attorney before making any changes to existing third party contracts you may have in place.

Ready to Get Started?

Our approach begins with understanding your needs and goals, so please contact us to get started.

Contact Our Specialty Practice Team

Please complete the form below to have a member of our team reach out to you.